All Categories

Featured

Table of Contents

We make use of data-driven approaches to assess economic products and solutions - our testimonials and scores are not affected by marketers. Boundless financial has actually captured the passion of lots of in the individual financing world, guaranteeing a path to financial flexibility and control.

Limitless banking refers to a monetary approach where an individual becomes their very own banker. This principle rotates around the use of whole life insurance policy policies that gather cash money value gradually. The policyholder can borrow versus this cash worth for numerous financial demands, properly lending money to themselves and repaying the policy by themselves terms.

This overfunding accelerates the growth of the plan's cash value. Infinite financial offers lots of benefits.

What is Life Insurance Loans?

It entails making use of a whole life insurance policy to produce a personal financing system. Its performance depends on different variables, consisting of the policy's framework, the insurance company's performance and exactly how well the method is handled.

How much time does limitless banking take? Unlimited banking is a lasting technique. It can take a number of years, frequently 5-10 years or more, for the cash value of the policy to expand completely to start borrowing versus it successfully. This timeline can vary depending on the plan's terms, the costs paid and the insurer's performance.

How flexible is Life Insurance Loans compared to traditional banking?

As long as premiums are existing, the insurance holder merely calls the insurer and demands a financing against their equity. The insurance company on the phone won't ask what the finance will certainly be utilized for, what the income of the customer (i.e. policyholder) is, what various other assets the person may need to act as security, or in what duration the individual intends to pay back the financing.

Unlike term life insurance policy products, which cover only the recipients of the insurance holder in case of their death, whole life insurance covers an individual's whole life. When structured effectively, entire life policies produce a distinct earnings stream that boosts the equity in the policy gradually. For additional analysis on just how this jobs (and on the advantages and disadvantages of whole life vs.

In today's world, one driven by benefit of consumption, too lots of consider granted our nation's purest beginning principles: liberty and justice. The majority of people never ever quit to think about exactly how the products of their financial institution fit in with these merits. So, we present the basic inquiry, "Do you really feel liberated or warranted by running within the restrictions of business lines of credit report?" Click below if you wish to find an Accredited IBC Practitioner in your location.

How long does it take to see returns from Private Banking Strategies?

Reduced car loan rate of interest over plan than the conventional financing products get collateral from the wholesale insurance coverage plan's cash or surrender value. It is a concept that permits the insurance policy holder to take financings on the whole life insurance policy policy. It must be available when there is a minute economic problem on the person, wherein such loans might assist them cover the monetary load.

The insurance policy holder needs to link with the insurance policy firm to request a funding on the plan. A Whole Life insurance coverage plan can be described the insurance policy item that gives defense or covers the individual's life.

The policy may need regular monthly, quarterly, or yearly repayments. It begins when a private occupies a Whole Life insurance plan. Such plans may invest in company bonds and government safeties. Such policies retain their values as a result of their conservative approach, and such plans never purchase market tools. Infinite banking is a concept that enables the policyholder to take up lendings on the entire life insurance coverage policy.

Can I use Private Banking Strategies to fund large purchases?

The money or the abandonment worth of the whole life insurance policy works as security whenever taken financings. Expect a specific enrolls for a Whole Life insurance policy policy with a premium-paying term of 7 years and a policy duration of 20 years. The private took the policy when he was 34 years of ages.

The collateral obtains from the wholesale insurance policy's cash money or surrender worth. These aspects on either extreme of the range of facts are talked about below: Unlimited banking as a financial innovation enhances cash flow or the liquidity account of the insurance holder.

What are the most successful uses of Wealth Management With Infinite Banking?

In monetary situations and challenges, one can make use of such products to make use of loans, thus alleviating the trouble. It offers the most affordable financing price compared to the conventional car loan product. The insurance plan lending can additionally be readily available when the person is unemployed or facing health and wellness problems. The entire Life insurance policy plan retains its overall worth, and its performance does not connect with market performance.

In addition, one must take only such plans when one is economically well off and can manage the policies costs. Infinite banking is not a rip-off, yet it is the best thing the majority of individuals can opt for to improve their financial lives.

What are the risks of using Wealth Management With Infinite Banking?

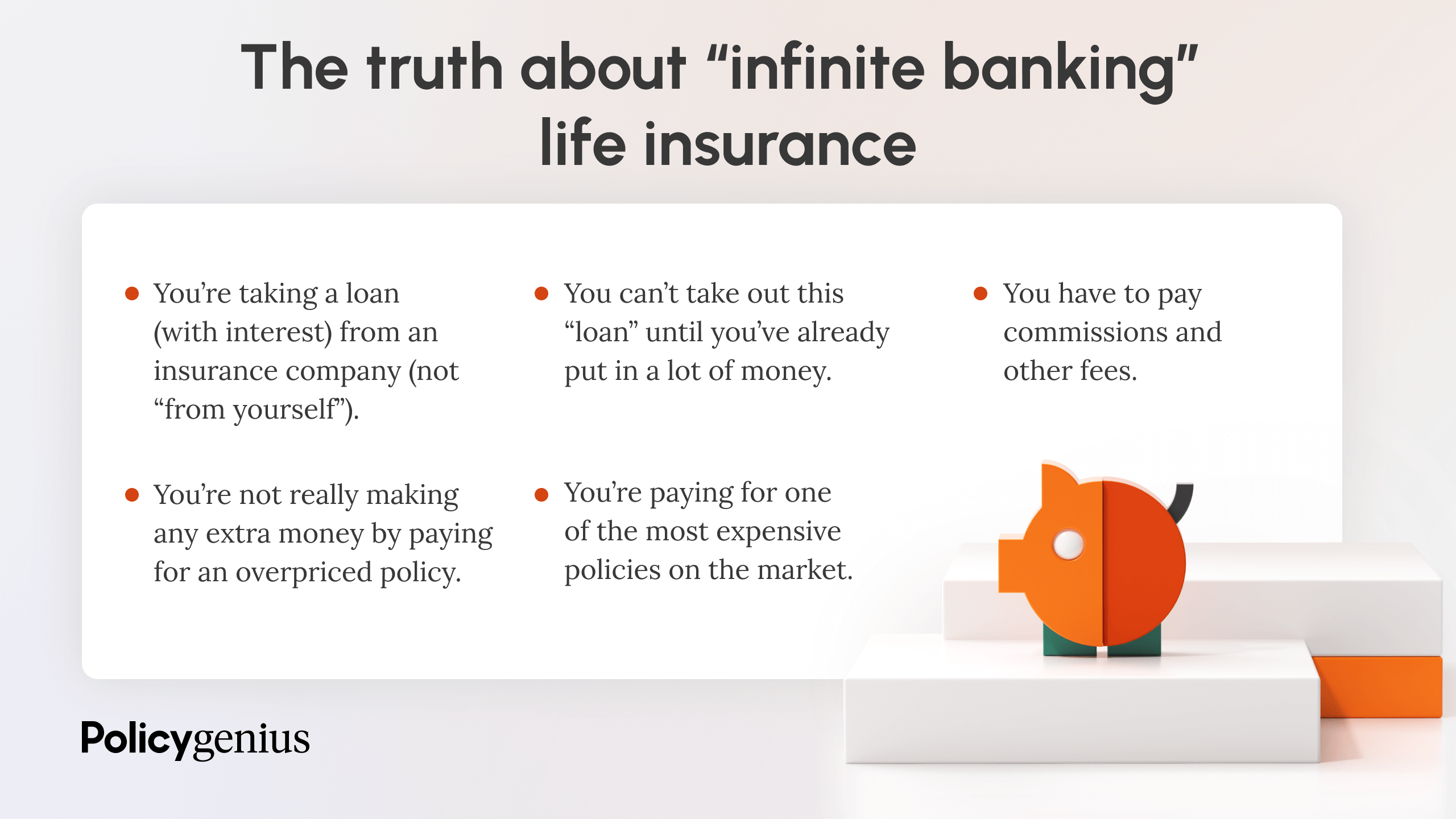

When people have limitless banking explained to them for the initial time it looks like a magical and risk-free way to expand wide range - Privatized banking system. The idea of changing the hated bank with borrowing from on your own makes a lot more sense. Yet it does require changing the "despised" bank for the "hated" insurance business.

Certainly insurance coverage firms and their representatives like the principle. They invented the sales pitch to market more whole life insurance policy. But does the sales pitch live up to real life experience? In this short article we will certainly first "do the mathematics" on unlimited financial, the financial institution with yourself viewpoint. Due to the fact that fans of unlimited financial may declare I'm being biased, I will make use of display shots from a supporter's video clip and connect the whole video clip at the end of this short article.

There are no items to purchase and I will sell you nothing. You maintain all the cash! There are two severe monetary disasters constructed right into the infinite financial concept. I will subject these imperfections as we overcome the mathematics of how limitless financial actually functions and exactly how you can do far better.

Latest Posts

Life Without The Bank & Becoming Your Own Banker

How Do I Start My Own Bank?

Whole Life Insurance Infinite Banking